REGION

Penhalonga is a small town, located in Manicaland in eastern

Zimbabwe. Its hidden in the heart of the eastern highlands of

Zimbabwe, where tradition meets modernity. Its spectacular sights

and natural resources create the perfect background for a business

activity. Penhalonga is located about 18 kilometers north of Mutare

city, the main urban centre of the Manicaland region and one of the

most important cities in eastern Zimbabwe. Mutare is an important

commercial and cultural centre with developed infrastructure

including schools, hospitals, shopping centres and transport services.

The biggest advantage of Penhalonga is being located only a dozen or

so kilometers west of Mozambique’s border and important

communication routes leading to Beira — Mozambique’s main port on

the Indian ocean. What’s more is that its located nearby A3 road,

which connects Mutare with Harare, capital of Zimbabwe, and with a

border crossing Forbes — Machipanda. Such location make sit a good

place for international trade and cross border cooperation.

GOLD OF PENHALONGA - TREASURE HIDDEN UNDERNEATH

The gold deposits at Penhalonga are of extraordinary depth and richness. They

are part of one of the most important gold-bearing belts in Zimbabwe,

stretching across the entire eastern part of the country. Gold in this region

comes in several forms - both as nuggets hidden in quartz veins and particles

scattered in metamorphic rocks. They are distinguished not only by their

abundance, but also by the quality of the ore. Gold ores in this region are rich in

minerals, which makes them extremely attractive to investors and mining

companies. Gold deposits in Penhalonga can be divided into alluvial deposits,

which can be found closer to the surface and are located mainly in greenstone

belts, and primary deposits, which occur in quartz veins that cut through the

granite massifs of the region. These unique geological formations, part of the

Zimbabwe Granite Shield, contain extremely high-quality gold.Some are

several dozen meters wide and stretch for many kilometers, which makes the

mining potential enormous. Such diverse forms allow the use of various

mining methods, which increases the flexibility and operational possibilities of

investors. These gold deposits are of extraordinary quality and abundance,

making them one of the most sought after and valued in all of Africa. Gold

mined in this region is famous for its exceptional purity and high market value.

HISTORY OF PENHALONGA FROM GOLD RUSH TO PRESENT DAY.

Penhalonga is a place with a rich history of gold mining. From the late th century unl taday, the

region has attracted adventurers. investors and miners From all over the world. It was here that some of

the mest important events of the Zimbabwe Geld Kush tock place, shaping the future of the regien and

its communities. Penhalonga has a rich and fascinating history that dates back to the late th century,

when the first geld depesits were discovered by ee settlers. In 1890, the Redwing mine was

established here, which over time hecam me ene of the most Impertant gold mining centers in the country.

The early years of the mine’s evelopment were Marked by difficult working conditions, but alse by great

enthusiasm and hope for wealth, which attracted hundreds of prospectors from all over the world. Ac the

beginning of the 20th century, thanks te investments and the influx of new technologies. the mine

became a significant gold producer. Mining rook place both above and underground, allowing the

exploitation of rich quartz veins that contained large amounts of high quality gold. During the interwar

perind and after World War IL, Redwing was one of the leading gold producers in Zimbabwe. The mine

attracted investors from all over the world, and the local community flourished thanks fo the growing

demand for gold. However, in the 1970s and les, the mine began to suffer From problems related to the

depletion of readily available resources, as well as the economic and political difficulties that were

affecting Zimbabwe at the time. As a result, geld mining was partially limited and the mine faced

challenges related ta medernization and restructuring. Currently, the Redwing Mine is experiencing a

periand of rebirth as the region is onee again in the spodighe of investors interested in gold expleration

and exploitation. Penhalonga’s gold deposits are still abundant and their porential has not been fully

exploited. Thanks to medermn mining technelogics and improved infrastructure, it is possible te increase

extraction and reeever resources that were previously considered unavailable.

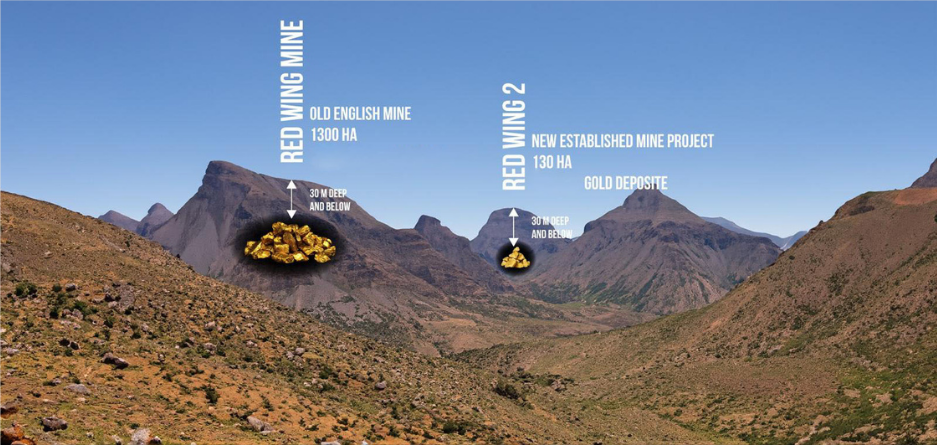

MAIN DEPOSITS AND THEIR IMPORTANCE

Red Wings mine, located in the heart of Penhalonga, is not only ene of the

most Famous, but also historically most important gold mining sites in the

region. For years, it was a symbol of the wealth and strategic importance of

Zimbabwe's gold deposits. The mine's reserves are estimated to exceed 80

tonnes of gold, with the potential for this Hgure to increase with Further

gee ological. exploration and a better understanding of the deposit structure.

Redwing has been at the forefront of domestic production since the 1990s,

achieving impressive results of 5,000 20,000 ounces of gold per year.

Although some of the sceposits have already been exploited, they still contain

significant wealth. Modern mining technologies create opportunities ror

even more elTective recovery of this valuable metal, which may transform

Redwing into one of the most impertant places on the geld map net only in

Zimbabwe, but also en the entire African continent. These deposits are

distinguished by their extraordinary quality and purity, which makes them

invariably desirable on global markets and cimphasize ses their strategic

impertanee for the Future of mining in the region.

DDTZ-OZGEO mine is one of the most intriguing and dynamically

developing gold mining sites in Zimbabwe. Co-created by a joint venture

between the Development Trust of Zimbabwe (DTZ) and the Russian

company OZGEO. This mine is an excellent example of international

cooperation in the mining sector, where local knowledge combines with

global expertise to create unique value in the raw materials market. The

gold deposits in this mine are impressive in both quantity and quality. To

date, DTZ-OZGEO has produced hundreds of thousands of ounces of gold,

and their long-term development plan envisages even greater production

in the coming years. Moreover, with further geological and exploration

research, there is a high probability of discovering new deposits, which

further increases the production potential oF this mine. Thanks to the use

of modern mining technologies, this mine not only maximizes the

elficiency of deposit exploitation, but alse minimizes the impact on the

local natural environment. DTZ-OZGEO's activities are strictly controlled

to ensure sustainable management of resources as well as maintaining

high ecological standards.

Muriel Gold Mine, although perhaps less

known compared to the giants of

Zimbabwe's mining industry such as

Redwing Mine, it holds a wealth of

inestimable value. This gold mine is a

perfect example of combining traditional

mining methods with modern technologies.

Gold deposits at the Muriel Gold Mine are

estimated at several million ounces, with the

prospect of significantly increasing

production through further exploration and

investment. This mine is characterized by

rich gold veins with high concentration,

which means that even at medium mining

depth, gold production remains at a stable

level. Annual production ranges from 10,000

to 15,000 ounces, which proves its

significant position in the local mining

industry.

GOLD MARKET IN 2024 THE RETURN OF KING OF STABILITY

In 2024, gold shines again, becoming a key piece of the

global financial puzzle. Once perceived as a safe haven

in difficult times, today it is gaining even more

importance. or decades, US Treasuries were

considered the safest investment, but changing

conditions such as rising interest rates, inflation and

geopolitical tensions mean that gold is once again

rising to the top as the safest reserve for countries,

investors and central banks. Not only is its value

skyrocketing, but it also symbolizes safety in an

unpredictable world.

HOW BRICS COUNTRIES SHAPE THE GOLD MARKET IN 2024

In 2024, the gold market has gained much importance, and the BRICS countries - Brazil, Russia,

India and China - are at the center of these changes. These four economies not only influenced the

global demand and supply of gold, but also played a key role i in shaping the prices of this precious

metal. In 2024, the gold market has gained much importance, and the BRICS countries - Brazil

Russia, India and China - are at the center of these changes. These four economies not only

influenced the global demand and supply of gold, but also played a key role in shaping the prices of

this precious metal.

DEMAND FOR GOLD

• China and India: China and India remain leaders in

gold consumption. In China, demand increased by 4% to

900 tonnes, mainly driven by the jewelry sector and the

growing middle class. India, despite economic

challenges, increased its demand for gold by 5%, which

translated into 600 tons. For both of these countries,

gold is not only an investment, but also a symbol of

security.

• Russia: In 2024, Russia continued its dedollarization

strategy, increasing its gold reserves to 2,500 tons, a 7%

increase compared to the previous year.

• Brasil: Brazil also increased its reserves to 140 tonnes,

seeking stability in times of currency instability.

GOLD PRODUCTION

• Russia and Brasil: Russia maintained its position as one of the

leading gold producers, with production of 330 tons. Brazil,

although smaller, has managed to increase production to 110

tonnes thanks to new investments and improved technology.

• India: Although India is not a large producer, in 2024 it began to

take steps towards developing its own mining sector.

• Increased production and recovery: In 2024, gold

production from mining increased by 4%, reaching an impressive

893 tonnes. This means that mines around the world have

increased their production to meet the growing demand for this

valuable metal. Ilowever, it was not only mines that contributed to

the increase in supply. Gold scrap that is recovered and processed

has played a key role in meeting market needs. In the first quarter

of 2024, 350.8 tons of gold scrap were recovered - 12% more than

a year ago

GOLD PRICES

The average gold price in the first quarter of 2024

Was USD 2,070 per ounce, an inerease of 10%

compared to the previous year. The price reached a

record high of $2.431/oz in April after the political

crisis between Israel and Iran escalated. At the

moment, it has already broken the price of USD

2,500 per ounce. Gold maintained its high value also thanks te

growing demand and strategic decisions made by

the BRICS countries. BRICS countries have become

key players in the gold market in 2024. The central

banks of these countries are aggressively increasing

their reserves to protect their economies from

nancial sanctions and geopolitical instability. For

these countries, gold becomes a key element of their

reserve diversification strategy and pretection

against external pressures. Their actions and

decisions clearly shape the ruture of this market,

both in terms of demand and price stability

GOLD MARKET IN 2024 IN THE CONTEXT OF AMERICAN TREASURY BONDS

In 2024, gold is gaining importance in the eyes of global

investors, especially in the Face of growing economic

uncertainty. Traditionally considered a "safe haven,” U.S.

Treasuries are starting to lose their appeal. Reason? The

increase in interest rates in the US and persistent inflation at

3-4% encourage investors to look for alternatives. Interest rates

are already reaching 5.5-6%, which is driving down the value of

bonds and prompting many to turn to gold. In 2024, there will

be a clear flow of capital from US treasury bonds to gold. Global

gold backed ETFs attracted as much as $50 billion in the first

half or the year, up 20% compared to the same period in 2025.

Meanwhile, about $100 billion was withdrawn from US.

Treasuries, reflecting investor concerns about future monetary

policy and inflation. This trend shows that investors are

increasingly turning to gold as a safer alternative in volatile

times.

Gold vs American treasury bonds

• Gold price: In 2024, the gold price will fluctuate between USD 1,900 and USD 2,000 per ounce, which

means an increase of 8% compared to 2023. This reflects increased demand for the precious metal,

particularly as a protection against inflation and market volatility.

• Yield on treasury bonds: The US 10-year Treasury yield rose to 4.5% from 3.2% in 2023. While

theoretically higher interest rates may make bonds more attractive, their falling market value as interest

rates rise discourages many investors, who are increasingly choosing gold as a safer haven.

• De-dollarization: This is onc of the most important trends affecting the gold market in 2024. This is the

process of many countries gradually reducing their dollar reserves in favor of gold and other assets. China,

which held $849 billion in US Treasuries as recently as 2023, reduced its reserves to $775 billion in April

2024 - the lowest level since 2009. Similarly, other BRICS countries such as Brazil, India and Russia have

also reduced their exposure to US Treasurics, investing in gold instead.

• Common currency: This is all part of a broader strategy to diversify forcign exchange reserves and

become independent from the US dollar. In 2024, many BRICS countrics are considering the creation of a

common currency based on gold, which could provide an alternative to the dollar in international trade

transactions. Such a currency would aim to inereasc the financial sovercignty and economic stability of

these countries.

Gold as a foundation of new financial system.

In 2024, central banks and pension and investment funds around the

world intensively increased their gold reserves, adapting their strategies

to new economic challenges.

Pension and investment funds: Pension and investment

funds, particularly in Europe and Northeast Asia, have also

increased their exposure to gold to diversily their porttolios and

reduce bond risk. In 2024, the average allocation to gold

increased to 7%, From 5% in the previous year, demonstrating

the growing importance of gold as a sate haven in difficult

limes.

Central banks: In 2024, central banks, especially in countries like

Russia, China and Turkey, have focused on accumulating gold in

response to rising inflation and political instability. Over the first three

quarters, these three countries purchased a total of approximately 300

tonnes of gold, contributing to an inerease in global central bank gold

reserves to 39,500 tonnes—1.59 more than in 2025. Since 2022, central

banks have purchased ever 2,000 tons of gold, which constitutes as

much as 816 of all purchases of this metal by state insdtutions. This

trend points toa shift away from the US dollar and a possible new role

for gold in the global financial system. Gold prices are up mere than 15%

in 2024, reaching the $2,100-$2,200 per ounce range, highlighting

rising demand and tight supply. Central banks played a key role in this

erowth, net purchasing 289.7 tonnes of gold in the first quarter—1%

more than the same period last year and 1295 above the 2025 quarterly

average. The largest buyers were the central banks of Turkey (30.1

tonnes), China (27.1 tonnes) and India (18.5 tonnes).

Geopolitics and gold: New era of uncertainty

The rise in gold prices in 2024 is also driven by rising

geopolitical tensions. Confilcts in regions such as the Middle

East, East Asia and Eastern Europe are prompting investors

to look for safe assets. Economic sanctions imposed on

Russia and potential sanctions on China increase

uncertainty in international markets, which in turn leads to

greater interest in gold as a risk-hedging asset.

Iran, a member of the Shanghai Cooperation Organization,

is also increasing its gold reserves in preparation for

potential sanctions and pressure from the West. This

organization, the largest regional military organization in

the world, brings together countries that together account

for 75% of the world’s population and nearly half of global

GDP, which further emphasizes the importance of gold as a

protection from geopolitical uncertainty.